May 8th, 2020 | Updated on May 18th, 2020

Did you know that under the Fair Labor Standards Act (FLSA) employers do not have to provide employees with pay stubs? The only requirement is to keep accurate records of the hours worked and how much was paid.

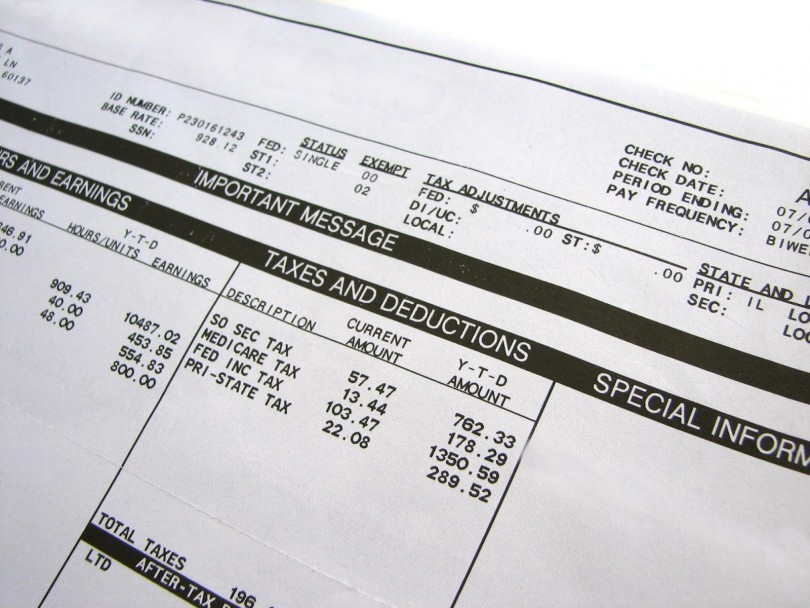

If you are wondering things like what does a pay stub look like, or what is a paycheck stub, you are in the right place.

We are going to go over all the information that you will find on a typical pay stub.

Information Included

While every pay stub might not look exactly the same, they will all include the same details.

This can help you and your employer keep track of all the payments you have received to date and each pay period.

The pay stub categories include gross wages, taxes, deductions, contributions, and net pay.

Gross Wages

This part of your paystub includes the money you receive before any deductions are taken out.

For hourly employees, these wages are the number of hours worked for the pay period multiplied by the hourly pay rate.

Employees paid a salary, the annual salary is divided by the number of pay periods each year.

Every payroll pay stub will have two columns next to gross wages, one column will show the wages before taxes for that specific pay period and the second column will show the year to date total.

If the employee receives overtime, sick pay, vacation pay, holiday pay, bonuses, payroll advances, etc on that paycheck, then each income has to be on a separate line underneath the gross wages.

Taxes

Taxes are paid to the government each pay period and depending on your state you might also pay state taxes and local county taxes.

Depending on your exemptions and state, the amount taken out in taxes will vary.

Common taxes include federal income tax, the employee portion of FICA tax, local income taxes, and state taxes.

Each tax deduction will have its own line and will show the current amount deducted for the pay period and another column showing the taxes paid since the beginning of the year.

Deductions

Some pay stubs will have deductions and some won’t. It depends on the employee benefits provided. Pay stub deductions can include payments toward loans, voluntary deductions, charitable contributions, etc.

Each deduction has to be on its own line and have two columns as well. One column will show the current pay period deductions and the other will show the year-to-date deductions.

Contributions

This is a list of the amounts the employer contributes towards the employee’s paystub. some of these items are not deducted from the employee’s gross pay.

Some examples of contributions are SUTA tax, FUTA tax, employer portion of FICA tax, insurance premiums, and retirement accounts. Every contribution also has to be on its own line.

Net Pay

This is the amount left over after all of the taxes and deductions are subtracted from the gross wages.

This is the amount that is taken home by the employee. This amount can either be deposited directly into the employee’s bank account or it can be paid via a check.

Net pay will also have two columns, one will show the net pay for the pay period and the other will show the amount paid to date, since the beginning of the year.

Understanding Pay Stub Information

As a business owner understanding an employee pay stub will help you in your business.

If you have never given an employee a pay stub, you can use a free paystub generator online to give to employees if the need ever arises.

Understanding and knowing pay stub information will make the process smoother when you have to pay an employee quickly because you either fired them or they quit.

The more familiar you are the easier and faster it will be for you to check that employees are paid the accurate amount.

You can also catch any mistakes done by the payroll department when you are familiar with pay stub information.

If an employee comes to you with a discrepancy you too can look for incorrect pay rates, total earnings, and hours worked.

State Laws

While pay stubs are not a requirement under the FLSA, there are states that require employers to issue a pay stub to their employees.

If you are a new business and are not sure if your state requires you to provide a pay stub, you can check your local Department of Labor website to see what the requirements are.

Some states that do not have a law in place about providing paystubs are Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee.

Because laws are constantly changing you always want to double-check to make sure you are not breaking any laws. This can lead to unwanted fines and other negative repercussions for your business.

Now You Know What Does A Pay Stub Look Like

Now you know the answer to the question “what does a pay stub look like?” As you can see there are a few different categories included in a pay stub.

Whether you are an employer looking to make your own paystubs to give to your employees, or an employee looking to make a pay stub to make a purchase or take out a loan, you can confidently take care of this task on your own.

Did our blog post help you today? Please bookmark our site and come back soon to never miss our latest helpful posts.